STOCK OF THE WEEK: HONDA:STRONG LINE UP

The Honda Motor Co

The Honda Motor Co(HMC) manufactures automobiles, motorcycles, portable generators and lawn motors. They develop and manufacture a wide variety of products, ranging from small general-purpose engines to specialty sports cars that incorporate their internal combustion engine technology. The Group

also provides financing for their products.

Honda's International office is located in Tokyo and has approximately 319 subsidiaries throughout the world including North America, Pakistan, the Philippines, India, South America and Europe.

The Japanese always seem to work hard developing state of the art products. Case in point, Honda introduced the first mass-market gas-electric hybrid car with the introduction of the Civic Hybrid in 2001.

The 2005 Honda FCX, the world's most advanced production fuel cell vehicle, is once again breaking new ground. Now fitted with Honda's

The 2005 Honda FCX, the world's most advanced production fuel cell vehicle, is once again breaking new ground. Now fitted with Honda's all-new, originally developed fuel cell stack (Honda FC Stack) the FCX is capable of starting and operating at temperatures as low as -20 C (-4 F) with improved performance, range and reduced build complexity. This new version of the FCX has received significant engineering upgrades, such as the capability of the stack to operate at below freezing temperatures and remain operational at high temperatures up to 95 C (203 F).

Honda

is not the biggest or most prestigious automaker compared with industry giants like Toyota and GM but they are a diversified manufacturer with total consolidated sales of about $80 billion. The automotive division provides about 80% of sales, motorcycles accounting for another 10%, and power products and financial services making up the remaining 10%.

To make up for their size, Honda

has developed a highly regarded flexible manufacturing system and hyper efficient supply chain that help hold down costs. Also, by trying to locating their manufacturing facilities near customers, Honda

has lower logistics costs, reduced exposure to foreign-currency fluctuations, and engineers who better understand consumer needs.

Coming directly from their web site- Honda's

success in the global marketplace relies on its commitment to continued investment in America's future. That's been their philosophy since they first started U.S. operations in 1959. It's what they believe in. It's what the consumer expects, and it's why they will continue to grow in America.

On a personal note, I have owned the same Honda Accord for the last 20 years. When I met my husband Chuck, he also owned a Honda Accord. Once we had children, we test drove all the mini vans on the market. We chose the Odyssey over the Sienna. Chuck’s mother drives an Accord and his father just replaced his Cadillac with an Accord. We feel and still do that Honda

offers the consumer high-quality and very popular products. Everywhere I look I see the Honda Element. My 12 year old daughter already has her eye on an orange one. Their newest product, the “Ridgeline” truck might be in my future.

This morning, Monday October 24th (HMC) closed at $27.40, up $3.80 from their 52 week low of $23.55 on 10/25/04. They reached their 52 week high of $27.73 on 9/20/05. 2005 has shaped up to be tough for most of the auto industry. However, Honda

seems to have a strong lineup of smaller cars which in turn use less gas. Remember, their financial division that makes up about 3% of sales now. Is this a growth area? The other question is will Honda keep working harder than their competitors to create a better, more fuel efficient “mouse trap” than the other car manufacturers?

Aditionally, this long time airline carrier continues to lower its operating costs. Not counting fuel, cost per available seat mile (CASM) at

Aditionally, this long time airline carrier continues to lower its operating costs. Not counting fuel, cost per available seat mile (CASM) at  Today, all airlines operate in an extremely uncertain industry. With the unpredictability of fuel prices, labor woes and poor economic conditions lurking behind every cloud, We believe there a silver lining for the future of

Today, all airlines operate in an extremely uncertain industry. With the unpredictability of fuel prices, labor woes and poor economic conditions lurking behind every cloud, We believe there a silver lining for the future of  Despite Hurricanes Katrina and Rita,

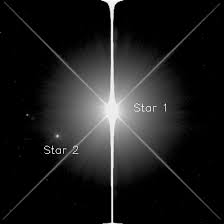

Despite Hurricanes Katrina and Rita,  A bright star in the sky? The average cost per available seat mile of the other major airlines in 2004 was almost 9% higher than

A bright star in the sky? The average cost per available seat mile of the other major airlines in 2004 was almost 9% higher than